The real estate sector has had several rough stretches. The global pandemic generated a temporary spike in residential real estate and a slump in commercial real estate (CRE). However, the gains have since diminished due to interest rate hikes through 2022/23.

As we enter 2025, renewed optimism is on the radar. Inflation is going down globally, and with it, interest rates. The European Central Bank has cut interest rates several times through the year to 3.25% in October 2024. The Federal Open Market Committee also eased the rates through 2024. Further cuts are expected in 2025.

As borrowing becomes cheaper, real estate businesses have renewed optimism. Among global CRE investors, 88% expect their company’s revenues to increase in 2025, a major shift from the 60% who expected further declines last year, according to Deloitte.

With new cash reserves, 81% want to reinvest their profits in data and technology. Real estate firms have long relied on intuition and retrospective data to make decisions—a tendency that left many vulnerable to unforeseen economic, climate, and compliance risks.

Data analytics and business intelligence (BI) can help real estate companies better understand the interconnected risks and opportunities to establish more profitable operations.

6 Data Analytics and BI Use Cases in Real Estate

The real estate sector has been slow to digitize. Big data analytics is already widely used in healthcare. Yet, 60% of real estate firms still use spreadsheets for time reporting, 51% — for property valuations and cash flow analysis, and 45% — for budgeting and forecasting.

Not only do legacy technologies create inefficiencies, but they also hamper decision-making. Only 13% of real estate companies can access up-to-date business intelligence and real-time analytics solutions.

And those who do, gain an edge over the competition. ‘Instant’ home offer platform, Upstix uses a data analytics platform to identify the most profitable properties. “[The tool provides] demographic type, propensity to sell, and property type, all in different regions within the UK. In the first three months of using this tooling, we increased our conversion by 3.5X,” shared Fred Jones, COO at Upstix.

Real estate companies have vast data reserves lying dormant. Operationalizing these reserves can bring major operational benefits. We’ve lined up the six most promising data analytics use cases for real estate to pursue profit growth.

Property Valuation

Real estate valuation is already a data-driven process. But it’s often ridden with inefficiencies as many records remain undigitized and legacy systems—disconnected. Data analytics solutions can help your teams consolidate and cross-validate insights from various sources including historical sales, neighborhood trends, climate insights, and social indicators to create more accurate valuations.

The new generation of automated valuation models (AVMs) uses machine learning algorithms to produce more accurate comparables and pricing. Compared to traditional, rule-based methods, ML models can identify new data correlations and respond to market signals faster than human evaluators. This increases the speed of decision-making and enables new largely-automated buying experiences like the iBuyer business model, used by Zillow, Opendoor, Trulia, or Zoopla.

Edvantis has helped KPC Labs launch an ML-powered engine for the US real estate market. Hosted on the AWS infrastructure, the system features real-time data integration pipelines and robust data enhancement services. The pre-cleansed data is then fed to several machine learning and deep learning models to produce:

- Predictions about likely-to-list (likely-to-sell) off-market properties

- Home value ranges forecasts and outliers based on competitive market analysis

- Customer behavior predictions for lead generation

- Similarity analysis across various propers

Moreover, AVMs are already supporting the majority of mortgage lending and mortgage-backed security risk assessments. 13 of the top 15 mortgage lenders in the UK use AVM as an integral part of their processes.

Climate Risk Management

With data analytics, real estate investors and developers can gain richer insights about the property’s potential return and risk. Advanced models can assess diverse data in multiple formats—visual floor plans, geospatial neighborhood data, demographic reports, traffic counts, tenant behavior, and more—to give more accurate ROI estimates and avoid being blindsided by risks.

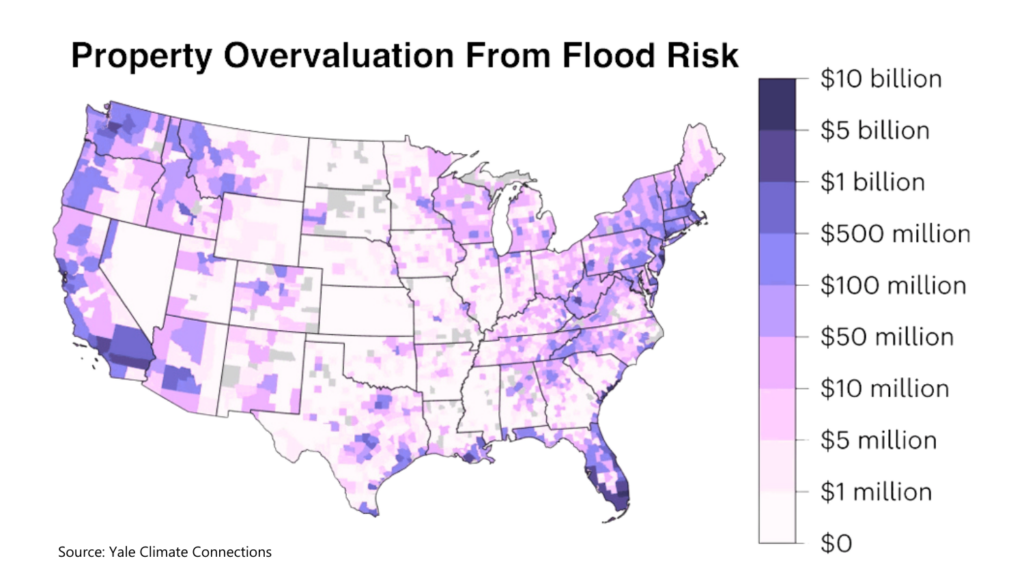

Across the US, some $121-$237 billion of properties are over-valued because of the current flood risk. Overvaluations create a negative chain effect. Home insurers pull out of high-risk areas, making property ownership even more expensive and posing a major economic threat to the real estate industry.

Source: Yale Climate Connections

Data analytics can help real estate companies better understand the real regional risks. For instance, ZestyAI has developed proprietary data models, offering risk and value insights about properties based on climate data. Its system evaluates the property’s vulnerability to hail, wildfire, storm, and wind damage. In addition, ZestyAI continuously monitors the property, detecting changes in roofs and facades, as well as recalibrating climate risks based on the latest data. This way, property owners can stay well-informed about potential risks impacting property value and take proactive loss control measures.

John Rogers, chief innovation officer at CoreLogic, is also a firm proponent of using data analytics for climate risk mitigation. The company recently deployed a Climate Risk Analytics tool, which allows companies to accurately measure and mitigate the impact of climate through every single property across the US up to the year 2050. The system calculates over 20+ detailed risk measures across various climate scenarios. The metrics can then be used by organizations to understand the physical and economic risks of climate change and the financial impacts on portfolios, so they can more confidently measure, mitigate, and manage risk.

Rental Profitability Analysis

Investors are obsessed with chasing top markets, indicating profitable rental opportunities.

BI tools can help gain more granular insights into the market trends, occupancy, and vacancy rates to optimize pricing and revenue in real-time.

Modern rental profitability analytics platforms automate data collection from public and internal sources, helping analysts generate more precise comp sets and daily unit-level rents to optimize revenue. Moreover, you can slide and dice property data to optimize cap rates, cash flow, or long-term appreciation, ensuring that your portfolio stays aligned with your investment strategy.

AirDNA specializes in data analytics for the short-term rental market. The platform aggregates rental rates, occupancy rates, and seasonal trends, to offer detailed analysis and forecasts for properties listed on Airbnb and VRBO. Using AirDNA’s platform, Venture REI managed to improve its occupancy rates from 48% to 92% before a big in-town event by adjusting the pricing according to the market signals. In addition, they improved conversion rates on inbound owner leads to 75%, doubling their short-term rental portfolio size in just 8 months.

Canadian commercial real estate developer CBRE Group Inc. also believes that the key to better rental profitability lies in data. Or more precisely–location data. The company developed a proprietary location intelligence technology platform. Dimensions combines aerial imagery, competitor locations, and census data to visualize market share and trade areas. With this data, CBRE Group Inc. can run a more comprehensive analysis of their clients’ portfolios to optimize profitability and find yet untapped market opportunities.

Tenant Management

Data analytics also extra efficiencies into tenant management processes, allowing property owners to find, approve, and sign on new occupants faster. Instead of manual forms and paper-based document submissions, your teams can automatically pull background data via APIs to pre-screen new applicants.

For instance, Doorloop property management software comes with a data-driven analytics engine for performing background, credit, and bankruptcy checks on prospective tenants in a matter of several clicks. The tool also automates other tedious tasks like payment collection and lease management.

Predictive data analytics tools can also alert property managers about tenant turnover. Silver Homes says its tools can forecast about 75% of tenant turnover using historical and behavioral data. Its technology also provides insights into reasons for moving, helping property managers ensure high occupancy rates.

Customer Engagement Tools

Compared to other sectors, real estate has been lagging in digital customer experience (CX). McKinsey found that residential rental companies offering a superior CX enjoy a 15% premium in net operating income (NOI), compared to players who skip on this, for buildings with similar characteristics.

The key to better CX is data as it enables more personalized, delightful experiences at unparalleled scale. Real estate companies that use technology to improve customer interactions enjoy a 2% to 4% increase in NOI and capture extra profits from the sale of ancillary services (including event space rentals, cleaning services, and grocery delivery), McKinsey says.

Data analytics can also become a launch pad for new customer-facing products. Redfin has transformed its massive data analytics program into public tools, now aiding it in customer acquisition and retention. The Hot Homes feature suggests to buyers which properties will sell off fast based on over 500 analyzed attributes, encouraging them to book a visit sooner.

Global real estate player Jones Lang LaSalle (JLL) uses data analytics to help its institutional clients make smarter portfolio management decisions. Over the years, the company recommended one of its clients more than 300 specific actions, resulting in $120 million in annual savings and a reduction of more than 2 million square feet of underperforming assets.

Optimized Marketing Strategies

Data-driven marketing has become the norm across industries, and real estate companies are catching up. With the help of algorithms, leaders are successfully optimizing their strategies for property marketing, lead generation, and lead qualification.

Over the years, Keller Williams has transformed from a residential real estate leader to a tech-led company, investing heavily in cloud, data analytics, and most recently AI deployments. In 2023, KW launched a new Paid Ads platform for its global workforce, offering agents a better experience for lead generation and qualification. The Automated Market Snapshots feature, for example, provides agents with instant hyper-local market analytics for launching ad campaigns. Opportunities APIs, in turn, allows KW agents to easily track and manage deals across the entire lifecycle.

Leadflow, in turn, developed intelligent lead generation software for real estate companies. It provides users with access to over 150 million property records to find different categories of leads and then qualify them using the platform’s AI algorithm. Each lead receives a score, based on their propensity to sell in the next 90 days. According to the company, marketing to such leads yields 271% higher response rates, compared to a general list of leads.

Time to Act on Data Analytics in Real Estate

Real estate isn’t short for data per se.On the contrary—it’s available in multiple formats, from multiple public and corporate systems. What many real estate leaders lack is the proper data management infrastructure to enable seamless data aggregation, cleaning, and transformation—an area where Edvantis can help.

As part of our data science services, we help companies create the optimal infrastructure for launching advanced data analytics solutions and scaling business intelligence adoption across the entire company. From database optimization to data pipeline optimization and custom ML model development, we help real estate businesses gain the most out of their dormant data. Contact us to learn more about our services.