The convergence between physical and digital aspects of mobility is increasing. Connected vehicles support real-time data exchanges with smart road infrastructure and traffic management systems. Intelligent transportation systems and traffic analysis solutions help urban planners create more efficient traffic flows and enable seamless multi-modal transportation journeys.

Greater connectivity, data availability, and are powering major digital transformations in the mobility sector, creating yet untapped opportunities for revenue diversification. Edvantis regularly brings technology and business leaders to discuss what’s happening in the transportation sector. Here are our main findings.

4 Sectors of Innovation in The Mobility Sector

Three forces are shaping the transformation of the mobility sector: consumer demand, regulations, and technology.

Car owners have a growing interest in electric vehicles (EVs) and software-defined vehicles (SDVs). Although many also want agile, on‑demand, and affordable alternative transportation (car sharing, e-bike rentals, and more). Regulators, in turn, are pushing for greater adoption of public transportation and reduced car ownership, which can cut sharply into OEMs’ revenues unless they consider new digital-enabled revenue streams beyond car sales.

All of these major changes are fueled and enabled by emerging technologies that create new opportunities for innovation across the following four axes.

1. Software-Defined Vehicles

The automotive sector continues its push towards software-defined vehicles — car models with add-on features, primarily or entirely enabled through software, rather than hardware characteristics alone. By 2030, more than 95% of the passenger cars sold are likely to have embedded connectivity. This shift presents major opportunities for new value creation, both for OEMs and other players in the mobility ecosystem.

The emergence of software-defined vehicles will create over $650 billion in value for the auto industry by 2030, making up 15% to 20% of automotive value.

BCG

And the possibilities for monetization are endless:

- Advanced Driver Assistance Systems (ADAS) and Level 2, 3, and 4 autonomy features

- Predictive maintenance offerings, powered by real-time vehicle telematics data

- Telematics insurance products via partnership agreements

- Battery charging and management optimization (for electric vehicles)

- Personalized infotainment experiences, powered by a growing app ecosystem

In-car services, in particular, are a rapidly growing market. Five in six automotive executives believe that digital services will be the key differentiating factors for competitive advantage in the automotive industry by 2040.

Mercedes-Benz is working on an MB.CONNECT package — a bundle of in-car digital services, covering comfort, improved driving, and on-the-go entertainment. The company expects that from 2025 onwards, it could bring 80% customer retention and extra profits.

General Motors also invested in building an end-to-end vehicle software platform (already coming with the latest model releases) to support over-the-air (OTA) updates, vehicle-to-everything communication (V2X), and its newest batch of in-car services. The OEM hopes to generate over $25 billion in revenue from in-car subscriptions by 2030.

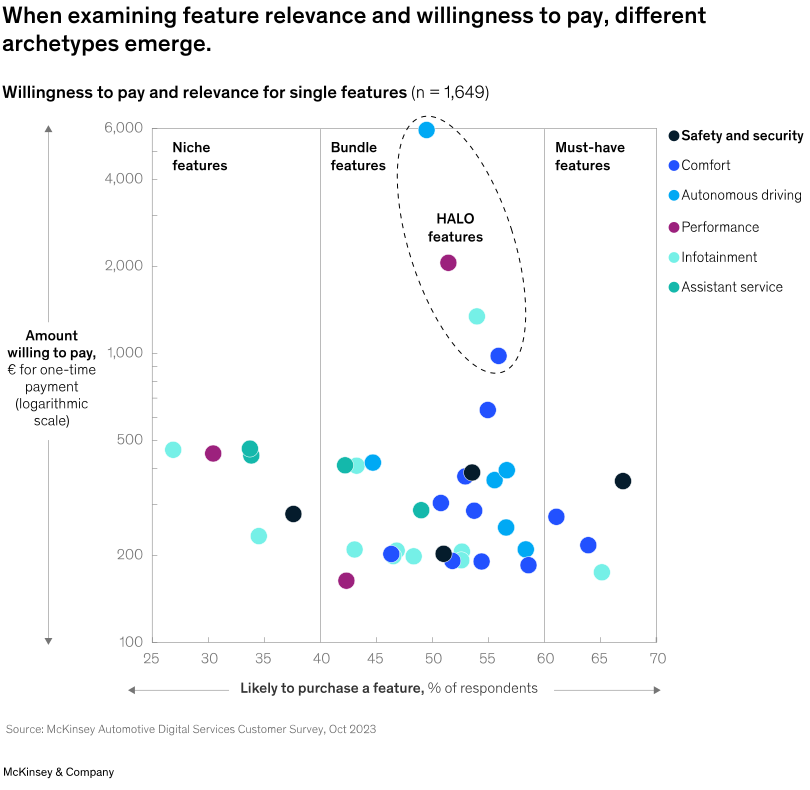

Consumers appear enticed. According to McKinsey, 49% of German and 58% of US consumers in the premium segment are very likely to buy a car with connectivity features. Almost 40% of US and German buyers are also open to switching automotive brands for better connectivity.

Yet, consumer enthusiasm often fizzles out when it comes to purchases. The majority aren’t ready to pay extra for individual digital services or bundles at the current prices.

Source: McKinsey

Likewise, many are concerned about how new features will affect their privacy — and automotives so far haven’t excelled in this area. A report from Mozilla gave 25 major OEMs failing marks for consumer privacy. Among the evaluated connected car brands, 84% shared vehicle owner data with third-party service providers and data brokers, oftentimes for a profit and without customers’ explicit agreement.

Clearly, OEMs need to further refine the value prop for in-car digital services both to set more competitive prices and to address rightful concerns about privacy and security.

Opportunities For Innovation

- Ethical ecosystem partnerships. Collaboration with third parties (insurance companies, mobility services providers) should be transparent for end-consumers. To achieve that, OEMs will need to implement a more transparent data governance process to prevent sensitive data leaking and a greater degree of customer data anonymization. Masked consumer data can still produce substantial benefits with the right data science approach.

- Cybersecurity solutions for connected vehicles. A standard connected vehicle can generate 25 GB of data per hour and collect information from more than 100 different data points (including sensitive ones like geolocation or biometrics). A data breach poses major risks. The development of new digital services thus requires strong security practices (in addition to secure hardware and middleware components) — extensive application and API security testing at every stage, which can be achieved with modern QA automation frameworks.

2. EV charging infrastructure

By 2030, EV stock can expand to almost 350 million vehicles. But future sector growth will hinge on public-private efforts to expand EV charging infrastructure availability. The US Department of Energy estimates that 1.2 million public charging ports will be needed by 2030. The EU is short on 8.8 million EV charging points.

EV charging services are expected to expand by about 35% a year globally to $12 billion by 2030.

Oliver Wymann

Players from multiple industries are already working in that direction. Brooklyn-based Itselectric aims to bring more Level 2 charging points to urban blocks by using existing energy infrastructure. The team partners with property owners and city officials to install curbside charges and share profits with nearby property owners.

IONITY, a joint initiative by BMW Group, Ford Motor Company, Mercedes-Benz AG, and Volkswagen Group, has already built over 450 high-performance charging stations across Europe, delivering up to 350 kW of power per charge. In the US, BMW, GM, Honda, Hyundai, Kia, Mercedes, and Stellantis, launched a similar project this year. Ionna promises to construct over 30,000 charging stations across the U.S. by 2030.

As part of their digital transformation efforts, energy companies also seek EV infrastructure deals. EDF and global infrastructure investor Morrison signed a partnership deal to deploy 8,000 ultra-fast charging points across France by 2030 to support EV market growth. Mer, a European EV charging company owned by Statkraft, recently signed a deal with IKEA in Germany to install 1,000 charging points across 54 locations nationwide.

EV charging infrastructure construction, however, is just one aspect of the problem. To support the growing load on grids, the mobility sector will also need to implement new software solutions for EV charging infrastructure management — a market ripe for innovative software solutions.

Opportunities For Innovation

- Smart charging & load management. To ensure EV charging station profitability and avoid excessive loads on the grids, operators will require analytics-driven solutions for fleet charging coordination. For example, for larger commercial owners, you can offer features to create prioritized scheduling queues, which correspond to the planned vehicle usage time slots (e.g., to cover a morning delivery route of 300 km). Or, on the contrary, delay charging for off-duty vehicles to benefit from off-peak energy tariffs.

- Secure user authentication. Consumers will expect a simple, seamless, and secure chatting experience. In connected EVs, the process can be effectively streamlined with the help of digital car IDs, NFC, and/or license plate recognition technologies. Depending on the planned route, the management module can also suggest the optimal charging schedule once the vehicle is docked. Seamless roaming between different EV charging networks, which can be enabled through partnership deals, is another advantageous feature.

3. Mobility as a Service (MaaS)

Urban planners continue to make a big push for reducing private car ownership to achieve ambitious sustainability goals. Finland’s capital, Helsinki, aims to make it unnecessary for any city resident to own a private car by 2025. Singapore started a 15-year plan in 2017 to reduce residents’ reliance on cars.

Alongside investments in public transportation and bike lanes, many cities are also increasing their support for MaaS players — car-sharing, micro-mobility, and autonomous shuttle companies — to create seamless multimodal transportation experiences.

MaaS platforms integrate multiple transportation options into one user-centric mobility offering, allowing customers to seamlessly switch between state and privately-operated modalities. Berlin’s Jelbi offers access to 12 different local options, including all public transit routes and ‘shared’ offerings like bike, car, and e-scooter rentals. Dutch umob does the same across the Netherlands and has an ambitious plan to expand to new markets in Europe.

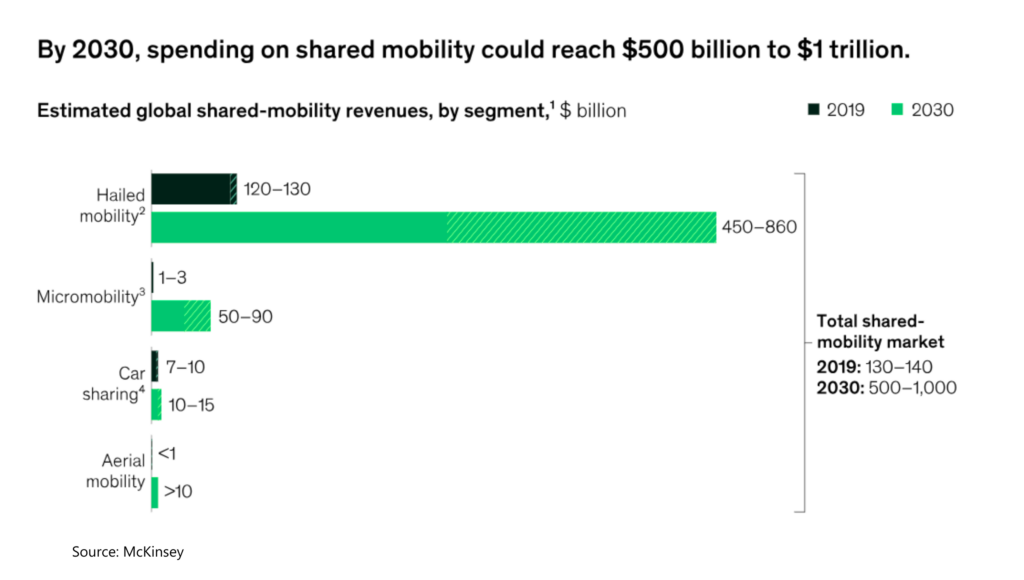

Overall, usage of MaaS applications has been growing steadily year-on-year and is set to reach $1 trillion globally by 2030.

Source: McKinsey

New transportation modalities like autonomous shuttles can further accelerate the sector’s growth. By 2030, some 10,000 autonomous shuttles may be cruising through Hamburg, Germany. The city recently launched a consortium of six project partners: public transport operator HOCHBAHN, on-demand service provider MOIA, vehicle manufacturers HOLON and Volkswagen Commercial Vehicles (the latter backs MOIA service); as well as the Karlsruhe Institute of Technology (KIT) and the Hamburg Authority for Transport and Mobility Change (BVM) to work on this vision.

Mobility-as-a-Service (MaaS) provider, Moovit, in turn, has partnered with May Mobility to accelerate the integration of autonomous vehicles (AVs) in public transport networks. May Mobility’s AV fleets will be integrated into Moovit’s urban mobility app and soon available for bookings in select locations.

However, to continue expanding their user base, partnership ecosystem, and market presence, MaaS companies will have to also address some of the present-day inefficiencies in their platforms, primarily around user experience.

Opportunities For Innovation

4. Streamlined Payments

Until recently different players in the transportation sector mostly relied on third-party payment processors to handle all transactions: fuel, toll, parking, and ticking payments. But, by doing so, many have missed the opportunity to capture extra transactional revenues and innovate the customer experience.

Directly embedding payment solutions into your solutions provides multiple advantages:

- Reduced transaction costs

- Faster settlement times

- Seamless customer experience

- New revenue streams

And, in case of the public transportation, greater passenger volumes. Visa survey found that 41% of passengers would use public transport more often if contactless payments were available. Another 47% also want more fare-capped rides. Contactless open-loop ticketing systems allow the implementation of these solutions. Card taps are faster and more convenient than cash fares or pre-paid card top-ups for residents and visitors alike. Edvantis has helped develop a ticketing device and supporting payment software for Stockholm’s Lokaltrafik AB (SL) with such features, now used by over 800K passengers each month.

Such systems can be also programmed to support subsidized fairs — for kids or the elderly. The Los Angeles Department of Transportation and LA County Metropolitan Transportation Authority designed a mobility wallet as part of its Low-Income Fare is Easy (LIFE) program. The wallet app provides subsidized access to a wide range of local mobility options. Moreover, mobility wallet solutions can also include special fares for passengers who are switching between private vehicles and public transport to incentivize trips by alternative means.

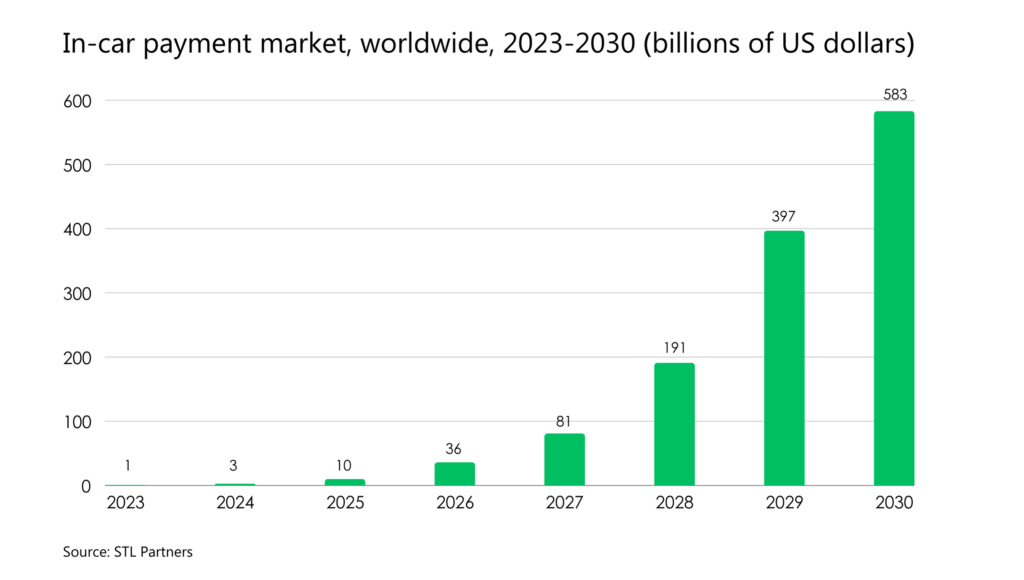

In-car payments is another coming-of-age market with strong commercial potential. With increased vehicle connectivity, drivers and passengers can now complete more tasks on the go — order drive-thru, book a hotel stay, or purchase entertainment content. Not to mention the standard chores like paying for parking or toll roads. Thanks to in-built wallets and NFC technology, vehicles are becoming a new promising payment mechanism.

For OEMs and other mobility ecosystem participants, in-car payments offer a new opportunity to both improve CX and capitalize on transactional revenues. BMW recently launched an in-car fuel payment system, which allows owners to settle the payment at select participating stations without exiting the car. Sheeva.AI, in turn, is helping Citroen roll out an in-car payment product to settle transactions at 2 million fuel pumps, parking spaces, electric vehicle (EV) chargers, and other service points.

Pairpoint estimated that 40% of the total value opportunities, created by in-vehicle payments will come from EV charging or car fuelling. Road tolling, parking, and maintenance-related payments represent the rest of the market.

Opportunities For Innovation

- Intelligent tolling systems. Sensor-based tolling systems with contactless payments can help infrastructure providers minimize revenue leaks and OEMs — further elevate the payment experience. For example, ClearRoad tolling API provides full access to toll charge information across the US, which allows users to register multiple vehicles with different billing agencies from one interface.

- POS financing. Lastly, OEMs can also attract more buyers and retain a greater fraction of after-sales profits by offering more attractive financing solutions. Millennial drivers are increasingly interested in buy now, pay later (BNPL) offers for car repair, servicing, and MoT expenses. Citroen UK recently launched a BNPL offer to finance accessory purchases and repairs. Moreover, three-quarters of car buyers are open to purchasing a new vehicle fully online and seek out online auto-financing options with convenient, app-enabled account management. Offering such products is another major digital transformation opportunity for the mobility sector.

What’s Next?

The mobility sector has already gone digital, bringing in new delightful consumer experiences in driving, payments, fueling, charging, and multi-modal journeys. But several important blockers remain. The ecosystem will need to grapple with complex challenges around data privacy and security. Establishing robust data governance frameworks and building robust security perimeters will be critical to win over consumer trust.

Improvements in user experience are also necessary to accelerate the adoption of in-car subscription and payment services, as well as a greater focus on integrations with more mobility partners. Edvantis has been successfully helping transportation companies re-imagine their value proposition with new technologies — cloud computing, data analytics, and ML/AI. Contact us to learn more about our services.