The year 2020 was deterministic for cash in the payment industry: consumers have drawn back from it. According to Accenture, over $48 trillion worth of transactions will shift from cash to digital payments during this decade.

At the same time, global payments revenue is likely to rise by a compound annual growth rate (CAGR) of 8.3% and reach $2.3 trillion by 2026.

A shift towards digital payments strengthens the need for banks and merchants to constantly innovate their payment infrastructure. This shift creates a demand for contactless payment methods, open banking, digital wallets, and other payment trends.

So, how can businesses best prepare to profit from the new, digital-led payment ecosystem?

In this post, we analyze the market data and its implication for the market at large, as well as provide commentary on the new payment solution development.

- Digital Payments Landscape for the Upcoming Decade

- Defining Digital Payment Trends For This Decade

- 1. Diversification of Contactless Transactions Use Cases

- 2. Mobile Wallets To Remain a Booming Cross-Sector Vertical

- 3. Open Banking Powers New Payment Use Cases

- 4. Machine Learning for Fraud Prevention Enters Mainstream

- 5. Embedded Lending at POS

- 6. Banking as a Service (BaaS) Will Fuel the Rise of “Super Apps”

- Harness Emerging Digital Payments Trends to Your Advantage

Digital Payments Landscape for the Upcoming Decade

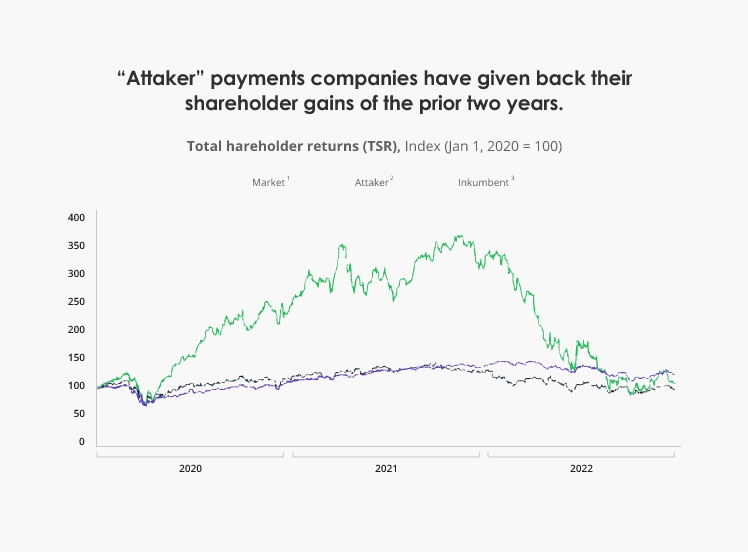

Since 2020, the payments market has remained in a constant state of volatility. First, growing at increased speeds due to rapid entry and revenue erosion by digital-led payment companies. Then, slowing in response to the constrained financial markets’ performance.

New digital payment solutions providers grew revenues by 68% between 2019 and 2021, according to McKinsey. Yet, a more modest forecast of 19% annually is estimated for 2021-2023. Incumbent payment companies, in turn, will maintain a steady growth of 10% YoY. In other words: emerging payment providers are now performing roughly on par with incumbents.

Source: McKinsey

However, the ‘status quo’ won’t stay for the long term. Heritage financial institutions still need to continue evolving the customer experience (CX) to retain existing customer bases, whereas payment startups and scale-ups will have to continue improving their profitability and product portfolios to maintain strong growth momentum.

Both sides, however, will likely step away from cut-throat competition and focus on collaboration instead.

86% of financial leaders agree that traditional payment providers will collaborate with FinTechs and technology providers as one of their main sources of innovation.

PwC

As digital transaction volumes go up and new payment methods emerge, companies in the financial space will likely choose to build joint financial ecosystems, which would deliver a better continuity and breadth of financial services to consumers.

By choosing to grow together with partners, payment startups and incumbents can jointly capture greater market share and increase revenues. Take it from SoFi — an online lender, which initially launched as a student loan comparison tool. Now, it has evolved into a one-stop-shop personal finance company that offers a range of credit and banking services.

In Q4 2022, the company generated a seventh consecutive quarter of record adjusted net revenue, which was up 58% and reached $1.5 billion for the entire year thanks to a “cross-buy momentum,” which is a central element of SoFi’s Financial Services Productivity Loop (FSPL) strategy.

The FSPL offers clients highly personalized financial products and services — both developed in-house or acquired via third parties. For instance, SoFi partnered with several banks to launch FDIC-insured checking and savings accounts. Likewise, they recently announced a partnership with Mastercard on a new buy now, pay later (BNPL) solution for all issued debit cards.

In fact, payment companies will see an acceleration of not only transactional revenue but also non-transaction-related (secondary) revenue streams, including account maintenance fees, foreign exchange, deposit interest, overdrafts, and other value-added services. However, the growth rates will be uneven across countries.

Source: BCG

New Payment Methods Proliferation Among Consumers

Part of the reason why FIs need to constantly evolve is the rising diversification of payment methods among consumers.

According to Mastercard, 85% of people in 40 countries used at least one emerging digital payment method (such as BNPL, eWallets, real-time payments, crypto, etc.). Another 93% indicated they’re very likely to try one of these new payment methods in the next year.

Modern customers also demand a more streamlined day-to-day experience for executing digital payments.

What does “streamlined” stand for when it comes to digital payment solutions? Several things:

- Portability: The customer’s wallet is no longer fat with notes; it’s full of cards used interchangeably to access different services and purchase products. Most people would prefer a single card (or mobile solution).

- Convenience: Online merchants have set a high bar for digital payment convenience — “invisible,” one-click checkout embedded in the application. In the physical world, people interact with other mediums to complete transactions (payment terminals, points of sale systems, vending machine interfaces).

- Security: Per FICO, only 41% of digital banking consumers are happy to use a username/password combo for security purposes. Over a half, like the concept of OTP passwords. Yet, 71% are eager to provide biometrics to their bank in exchange for a more secure and convenient payment experience.

To remain profitable for the long term, businesses will need to not just accommodate new payment preferences but also build a more convenient experience of using different options if they want to retain the core customer bases.

Defining Digital Payment Trends For This Decade

The payment industry evolves fast, yet some trends have proved to be persistent as they represent major shifts in consumer behaviors, regulations, and technology-led innovation.

We believe that the following six trends will define the new shape of the payment ecosystem:

1. Diversification of Contactless Transactions Use Cases

Contactless payments volumes remain on a steady upward curve since 2020 and will remain so for the next 5 to 8 years. Juniper Research expects global contactless payments to top $10 trillion by 2027, up from $4.6 trillion in 2022.

Consumers increasingly expect contactless payments to be available at desktop and mobile point of sale (POS). Moreover, 16% of US consumers say that the lack of a contactless payment option at checkout is a deal breaker for them at retail shops, and 13% of them say this is a dealbreaker at a restaurant, according to Square.

If your organization has been behind on EMV software development, the time to act is now. As the Federal Reserve Bank of Philadelphia rightfully noted: “Most of the technical impediments to contactless growth have been eliminated. Networks, issuers, and merchants are all prepared for contactless to take off.”

More mature organizations are also looking into alternative use cases for contactless transactions.

A contactless smart card can mesh together several capabilities:

- Serve as a standard payment debit/credit card

- Store personal credentials (such as passport data, driver’s license, or membership information)

- Act as an authentication key for accessing connected services

- Replace separate transport cards for public transit

In essence, a contactless smart card is a portable ‘digital wallet’ in the physical shape of a card, featuring a tamper-resistant microprocessor (chip).

Two security standards govern smart contactless cards:

- ISO/IEC 7810 ID-1: defines physical characteristics of smart cards.

- ISO/IEC 7816: defines security and data management standards for contactless cards.

By 2025, the global smart card market will reach $11.5 billion. Use cases for public transportation, amenities access, tourism, and e-government services access are actively explored worldwide.

2. Mobile Wallets To Remain a Booming Cross-Sector Vertical

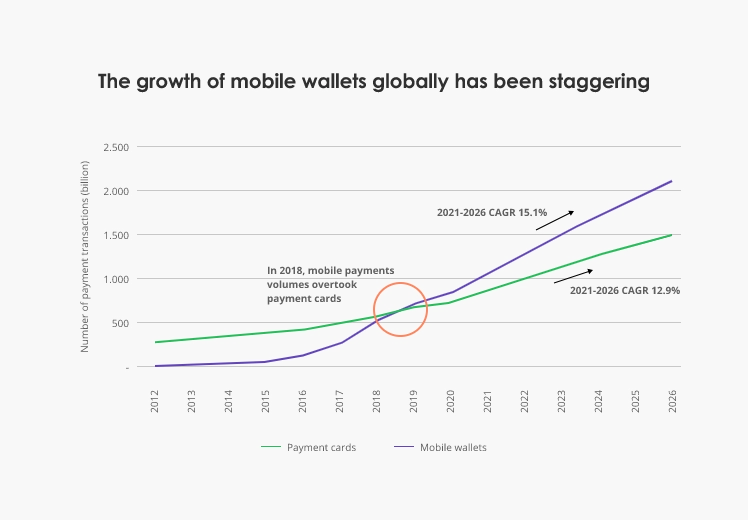

Mobile wallets, also called digital wallets, also remain in vogue. As the volume of contactless transactions continues to grow, more consumers are reaching for their phones instead of a debit or credit card.

Source: GlobalData.

According to GlobalData, mobile wallet payments will reach $120 trillion by 2025, growing at a compound annual growth rate of 19.9%. Juniper Research, in turn, expects that 60% of the global population will use a digital wallet in 2026.

The surged demand among consumers prompts more merchants to incorporate Tap to Pay on iPhone and mobile wallets like Cash App, Google Pay, and Apple Pay, among others, into their POS software.

“Customers are going to continue to embrace the wallets that match their preferences— whether it’s the type of phone they own or how they bank or even their location. Merchants should therefore prepare to offer a suite of wallet offerings based on their customers and their demographics.”

Brian Dammeir, President of North America, Adyen

In emerging markets, digital wallet adoption has been particularly strong. Poor access to traditional banking services has prompted local underbanked and unbanked consumers to seek alternatives. In Africa, over 621 million consumers use telco-issued mobile money wallets. The continent now accounts for 70% of the world’s $1 trillion mobile money value.

Governments and banks are also recognizing the earlier oversight in payment infrastructure design. With predominantly young and mobile-savvy populations, Asian FIs are choosing to launch digital wallets instead of traditional banking accounts. For example, Thailand’s PromptPay, developed by the local central bank, amassed over 56 million users in a country with a population of 71 million.

The European Commission, in turn, is working on new regulations and frameworks for introducing digital IDs for the local population, which can have substantial implications for digital payment solutions. Powered by a new European Mobile Payment Systems Association (EMPSA), the European Payments Initiative (EPI) aims to create a pan-European digital wallet.

Should digital IDs and digital euro become commonly used, the levels of interoperability between digital wallets, banks, and financial services would increase substantially. FIs will be able to carry out faster, more streamlined KYC/AML checks by procuring data from digital IDs and other accounts associated with the specific customer. Speaking of unrestricted customer data flows…

3. Open Banking Powers New Payment Use Cases

Open Banking is a UK-started and now globally accepted movement toward improving customer data portability in the financial space.

Some 7 million consumers in the UK used Open Banking services in January 2023 alone. The common use cases include bank account aggregation (i.e., the ability to keep data from multiple bank accounts in one place), personal finance management, and faster customer onboarding.

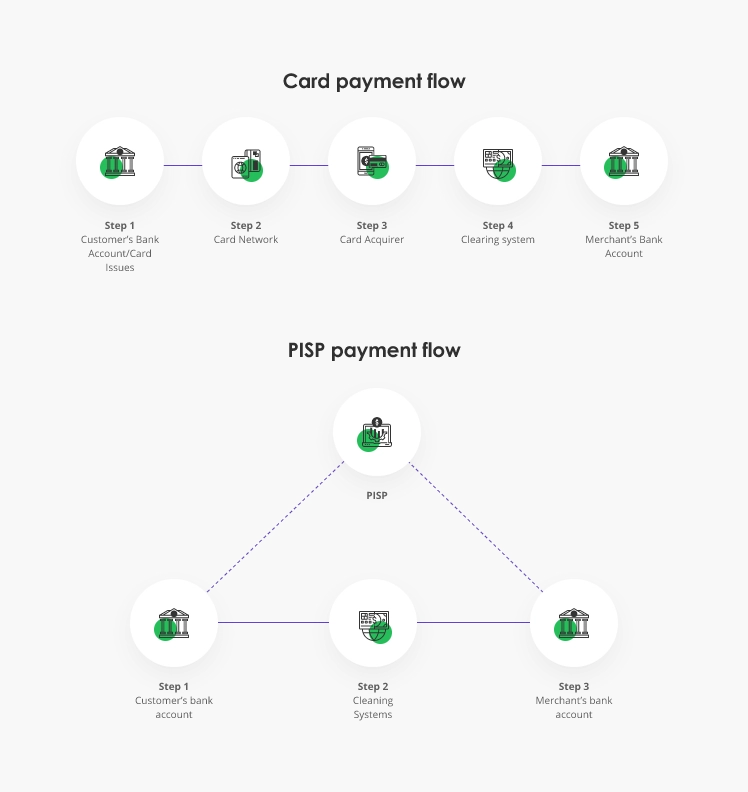

Open Banking payments have now become the next frontier for expansion. Such account-to-account (A2) payments can eliminate third parties — card acquirers, card networks, and settlement banks — from the standard payment processing flow.

Source: PSP Lab

With a payment initiation service provider (PISP) license, banks could move money faster between client accounts while saving on intermediary fees. Consumers, in turn, benefit substantially from lower fees and near real-time payment processing. According to McKinsey, Open Banking ecosystems can add up to 1.5% to the GDP of the EU, the UK, and the US.

Recurring B2B payments, in particular, represent an ample opportunity for monetization as consumers increasingly seek Variable Recurring Payments (VRPs). Over 40% of financial leaders expect an acceleration of cross-border, cross-currency instant, and B2B payments.

However, as the UK oversight committee for Open Banking implementation pointed out, “hurdles remain in customer experience.”

At present, the levels of high-value payment reliability and successful completion remain low. Many high-value account-to-account payments get declined because of sub-part customer authorization and payment security mechanisms, plus the extra friction in the form of additional screens or calls. These can be a particular bottleneck of ecommerce companies, who don’t have an existing relationship with the payee and therefore need to maintain a balance between payment security and customer convenience.

That said, payment companies who succeed in creating an effective, secure, and compliant Open Banking payment process will enjoy faster growth and profitability in this decade.

4. Machine Learning for Fraud Prevention Enters Mainstream

The flip side of digital payment growth is accelerating online payment fraud. In 2021, 71% of global organizations fell victim to payment fraud attacks. Moreover, digital payment fraud rates are accelerating.

The cumulative merchant losses to online payment fraud globally between 2023 and 2027 will exceed $343 billion.

Juniper Research

Financial companies will have to seek out more advanced security solutions to combat an expanded risk radar due to new payment methods proliferation and cyber-threats evolution.

Machine learning (ML) emerged as the strongest contender for battling payment fraud. Such algorithms can be trained on historical data records (suggesting normal or abnormal transactions) and then tasked to monitor, detect, and alert of any anomalies in payment data in real time.

Machine learning systems for fraud prevention are typically rules-based, meaning the algorithm relies either on heuristic or multi-parameter rules to determine the legitimacy of a transaction and then issue a decision (for example, block transaction processing if the IP is X).

For example, Stripe’s fraud detection system, Radar, evaluates each transaction by weighing hundreds of different parameters. These parameters include:

- Charge signals, e.g., time of day, card type, and card to IP address distance

- Behavioral signals, e.g., time spent browsing and number of pages visited

- Device signals, e.g., screen size, font type, and proxy use

- Aggregate signals, e.g., historical data of a card, number of countries tied to the card, email and cardholder match, etc.

By combining multiple rules, Stripe’s system can ensure a low level of false-positive transactions and minimal friction for the end user.

Consumers have also grown comfortable with the notion of AI-powered fraud detection. According to Experian, 45% of consumers in the UK and 38% in Ireland believe AI can help detect if attackers took over their identity or account or used their credit card without permission.

So, the investment rates in machine learning for fraud prevention will further accelerate as banks seek to balance security and customer experience.

5. Embedded Lending at POS

Buy Now, Pay Later (BNPL) has emerged as a new vector of lending market diversification, driven by ecommerce adoption. ePOS financing, which includes BNPL and ePOS Credit, is set to exceed $760 billion in ecommerce transaction value by 2025.

Yet, BNPL isn’t the payment trend worth watching.

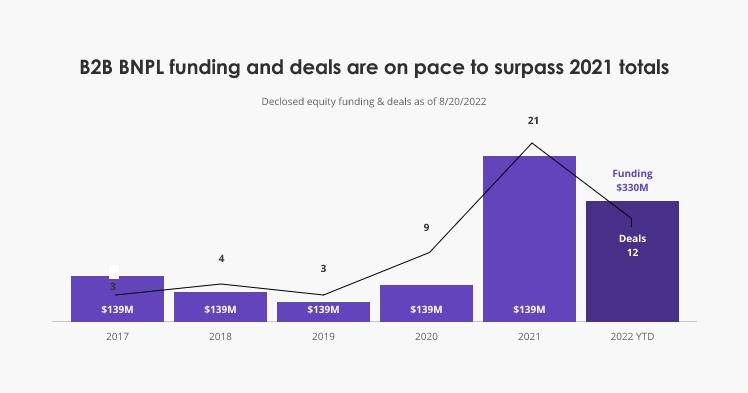

Beyond ecommerce, consumer interest in installment payments and POS lending is increasing in automotive, healthcare, and education. As new players enter the market, interest in POS lending is also picking up speed in the B2B sector.

Source: CB Insights

The total value of the B2B market in Western Europe is above $12 trillion, with $680 billion of these sales already taking place online, meaning an ample total addressable market for potential entrants. At the same time, rising interest rates will likely force more entrants to seek out alternative financing options, which new lenders could deliver.

Lending offers, embedded at the point of sale, could help businesses acquire the necessary supplies without straining their cash flow. At the same time, banks and credit institutions could reach new customers more easily and nurture them into lifetime customers.

For instance, Two recently launched a B2B payment platform with embedded lending options, together with Santander Corporate & Investment Banking (CIB) and Allianz Trade.

“Effectively if you input our solution, you can now offer your business buyers or customers the ability to check out and complete a purchase in about 30 seconds. And in that 30 seconds, you onboard them as an official customer through Two. We underwrite and take care of both the credit and fraud risk, verify that the user is actually who they say they are, and allow the buyer to complete the transaction [instantly],”

Andreas Mjelde, co-founder of Two

In this decade, such embedded lending experience will likely become the “norm” for both B2C and B2B sectors. Consumers will quickly access affordable financing, while business users will profit from more revenue and banking partners — from low-cost, seamless customer acquisition.

6. Banking as a Service (BaaS) Will Fuel the Rise of “Super Apps”

It’s no secret that established payment companies now have more than one revenue stream apart from transactional revenues. PayPal offers a host of financial services for businesses, including debit and credit cards, plus loans. Stipe built out a Treasury Service with the help of Goldman Sachs.

Increasingly, banks are choosing to become growth partners for promising FinTech startups (and often businesses in adjacent industries, too) by “lending out” their core banking infrastructure. In a nutshell, that’s what banking as a service (BaaS) stands for.

“Banking-as-a-Service market size stood at $637.40 Billion in 2022 and is projected to reach $6,943 trillion by 2030, growing at a CAGR of 32.9% from 2024 to 2030.”

Verified Market Research

Banks like Goldman Sachs, BBVA, Barclays, JPMorgan Chase, and Green Dot Corporation are among the leaders in the BaaS space. GreenDot, for example, backs Stash, Uber, Wealthfront, and Walmart MoneyCard. BBVA, in turn, lends its infrastructure to Simple, Digit, Catch, and Wise (for SMB), among others.

Smaller banks alike are turning to BaaS to remain competitive by diversifying their presence in the payment ecosystem. For example, Sutton Bank became a financial partner for Square’s new business banking services. A Luxembourg-based BaaS provider, MangoPay, in turn, grew strategic partnerships with The Food Assembly, KissKissBankBank, and Vinted, among others, now processing over €11.3 billion in transactions for its clients.

Financial institutions will continue to build an assembly of strategic integrations and partnerships with payments and FinTech partners, who’d benefit from faster time-to-market for new financial products and greater regulatory protection.

Harness Emerging Digital Payments Trends to Your Advantage

With the fast pace of innovations in the payment industry, new profit pools come to the fore. Every player in the financial sector can now grow vertically — by improving the depth and delightfulness of core financial services — and horizontally — by partnering with others in the payment ecosystem to launch or distribute extra services.

Despite the wider macro-economic calamities, the digital payments market will maintain a strong growth momentum. So, now is the best time to start preparing for the next growth curve.

Edvantis has substantial experience in software development for the payment industry. Contact us to receive personalized consultation about emerging payment trends and their application scenarios for your business.