If you have a product to sell, you need to provide a seamless payment experience. Or else, you risk never making that sale.

That’s a simple axiom every retailer knows. But lately, the “payment experience” part of the equation has become more convoluted. Consumers today no longer want to pay in cash. They are switching between different cards, third-party payment tools, digital wallets, and even crypto-assets, choosing contactless payments whenever possible.

In July 2020, over 50% of US consumers said that they’d been prioritizing touchless payment options and for 30% contactless card payments became the go-to option.

It may seem that “contactless” is a temporary, pandemic-prompted fad. But data suggests otherwise. Eight out of ten consumers expect local businesses to keep offering “pandemic-friendly” retail payment methods such as contactless payments and digital wallets even after the health crisis is contained.

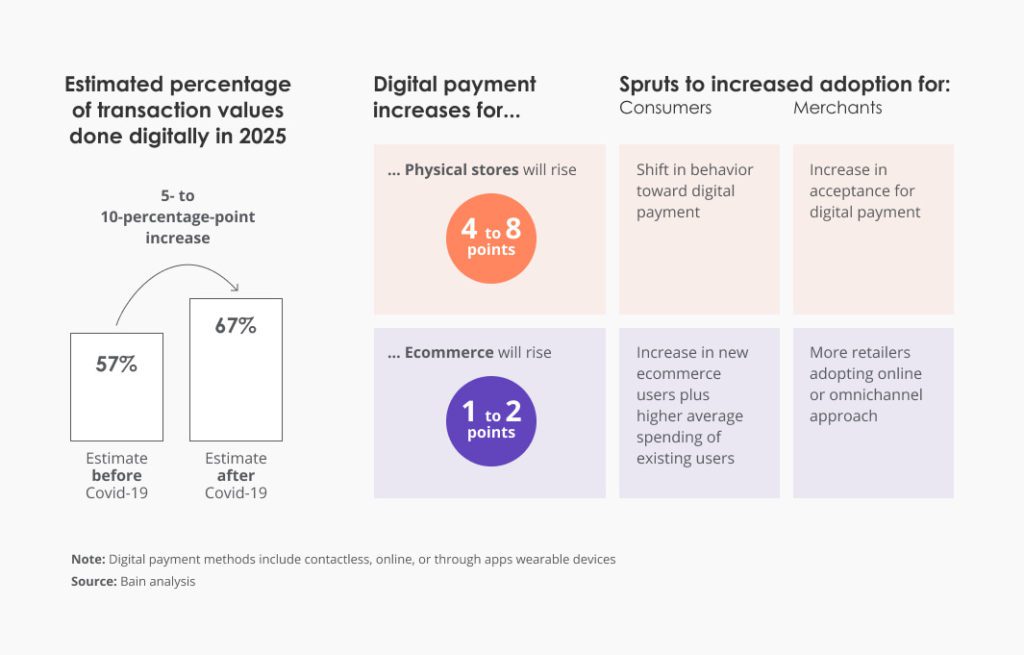

Source: Bain

In the second post in our payment series, I’d like to zoom in on the emerging payment trends in the retail sector and how retailers should technologically prepare to accept new payment methods.

How Merchants Should Adapt to The 2021 Payment Trends

Apart from changes in consumer behaviors, the payment landscape also evolves thanks to rapid technological progress.

At the end of 2020, Visa launched an Open Checkout initiative — an API-based option for merchants to easily integrate new payment methods into their digital products. Instead of investing in a new payment processor, retailers can integrate Visa Checkout to securely accept card and digital wallet payments (such as Google Pay or Apple Pay). That’s on top of the earlier innovations in the payment space such as PIN on Glass and PIN on Mobile payments, QR payments, and unattended retail solutions.

Despite a setback during the early months of the pandemic, the retail sector (along with overall transaction volumes) is getting back on track. To maintain an upper hand in the new markets, retailers will need to acknowledge the newly-emerged in-store and mobile payment trends and then act upon those.

1. Assess PIN on Mobile (PoM) Solutions

PIN on Mobile (PoM) is a new approach to accepting retail payments without investing in a POS terminal. Instead, of purchasing hardware, retailers can turn a consumer-off-the-shelf (COTS) device such as a tablet or smartphone into a full-fledged payment terminal for securely accepting payments.

In essence, a PIN on Mobile solution has two components:

- Payment hardware. Such as a secure card reader connected to the COTS device to read card chips.

- Software. Payment processing and POS software for conducting transactions and capturing customer data. The software component can be programmed to support different types of electronic payments — from cryptocurrencies to contactless payments.

Such a setup is more cost-effective than investing in standard payment terminals and POS systems. PoM also opens many new doors to what could be combined together with the payment process. For example automatic subscription to loyalty programs, customer analytics solutions, automatic cross-sells and up-sells, and more.

Such Android-based mobile phones as terminals can support more functionality than the standard payment processors available on the market. For example, process cryptocurrency payments.

Elon Musk recently announced plans for accepting bitcoin payments for Tesla. His earlier company, PayPal, also jumped on the train and bought over 70% of newly mined bitcoins in November 2020. Is PayPal planning to extend its payment processing portfolio and allow crypto payments? Could this lead to a reunite between Elon and PayPal, in Tesla using the PayPal platform to handle bitcoin transactions?

Only time will tell us the answer. But this movement gives us a good idea of one scenario within the retail payment space.

2. Consider POS System Upgrades to Support NFC Mobile Payments

Retailers with an existing payment infrastructure need to start accepting contactless (NFC) payments.

According to Mastercard, the volume of contactless payments grew by 25% in the APAC region with 91% of consumers saying that they now use tap-and-go payments. In the UK, contactless payments accounted for 88.6% of total card payments last year.

The global contactless payment market is projected to increase by 4X and reach $4.60 trillion in transaction value by 2027 (up from $1.05 trillion in 2019).

The rising preference for contactless has also opened the floodgate of mobile payments with digital wallets. Modern NFC retail solutions can use the NFC standard of our phone to communicate with a terminal accepting contactless payments.

Retailers do not have to invest in new infrastructure to accept payments from digital wallets — they only have to update their software components.

In my work, I am also seeing more requests for retailers to accept AliPay and WeChat payments. This can be particularly lucrative for retailers, seeking to attract more customers from Greater China. Over 850 million Chinese consumers use mobile payments. AliPay, respectively, holds over 54% of the market share. Currently, some merchants rely on a separate device to process AliPay payments. You can integrate this functionality into your POS systems too.

Additionally, you should consider extending your POS system with extra integrations such as:

- PayPal

- Klarna (or similar point of sale finance application)

- Crypto payments

- QR-code payments

Doing so provides consumers with more flexibility to choose a payment method that suits them best. This, in turn, increases the willingness to shop with your company, over another.

3. Plan for the Arrival of Contactless Smart Cards

As I mentioned in the first post of this series on digital payments, the payment industry is heading towards a consolidated payment experience, where a single ID-based contactless fulfills a wide range of needs — serves as a payment method, transport card, access key, and more.

The retail sector should also be part of the emerging ID-based smart city infrastructure.

Digital receipts, online membership program subscriptions, and integrated loyalty status are in-demand among consumers. For retailers, all of these present an excellent opportunity to collect more customer data. Then seamlessly connect with shoppers at different stages of their customer journey.

To boost adoption, retailers can opt not to issue separate loyalty cards. Instead, they can leverage consumers’ existing digital IDs and an ID-based solution to link up their membership status and purchase history to the payment method they are using during checkout.

4. Evaluate the Need for an Unattended Retail Experience

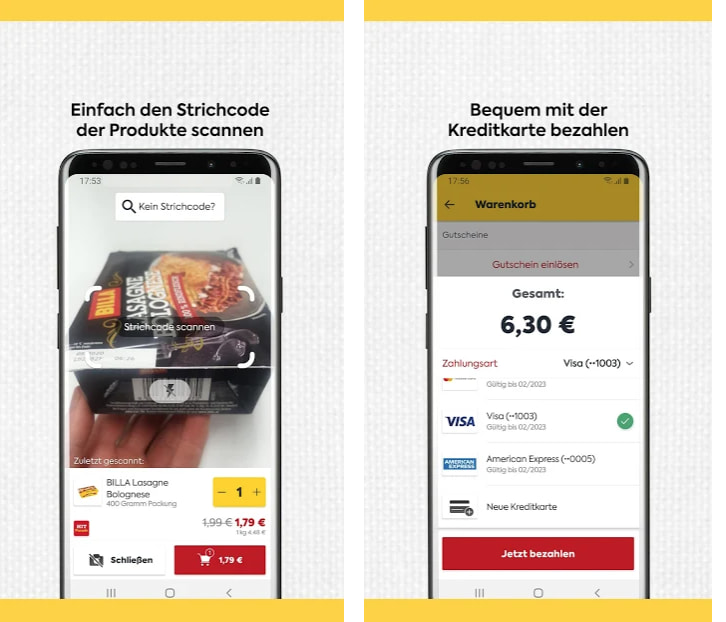

To improve convenience, some big-box retailers are deploying on-brand mobile shopping apps and in-store self-checkout devices. Instead of queuing for checkout, consumers can use a bar scanner to check out all the items and then settle the bill either via a mobile app or through a self-service payment terminal. Or even scan all the products with their phone and pay in one tap.

Examples of these include Carrefour’s SelfSCAN, Monop’s Easy, and Billa’s Scan & Go.

Source: Google Play

During the pandemic, we also saw similar mobile payment solutions adopted by restaurants, bars, and fast-food chains. To reduce queues, customers can order ahead via the mobile app, settle the bill and skip in-person interactions and crowds.

The next evolutionary step in the retail sector would be transitioning to fully unattended retail.

Such an experience would be similar to one offered by Amazon Go in the US, BingoBox in China, and Instant Systems in Sweden.

Unattended store technology and intelligent self-service kiosk systems are powered by several cameras, IoT sensors, face recognition technology, and weight monitoring shelves. AI algorithms continuously scan consumers’ actions, capture goods taken, and initiate payment when the person is ready to leave through the payment gate.

Today, unattended retail solutions are still in an early stage and not fully reliable. As with other emerging solutions, there are certain hiccups to overcome.

However, there are already promising signs of growth in demand. In the US, the value of the U.S. interactive kiosk industry market will reach $1 billion in 2021, according to a PYMNTS report. What’s even more important is that the majority of unattended retail consumers prefer to settle the bill using credit or debit cards, or digital wallets.

To Conclude

Prompted by the pandemic but now treated as a “given” contactless payments are sure to stay for the long-term. The consumers’ growing affinity for omnichannel retail and the growing fragmentation of payment methods also prompts retailers to rethink their approach to payment processing.

With the spending limits on pinless transactions raised (and likely to be further increased), the volume of contactless transactions will grow even further. Those who are not technologically up-to-speed for processing them risk of losing a good fraction of new business.

Learn more about Edvantis’ payment expertise or contact one of our representatives directly for a personalized consultation on your business case.